Local entrepreneurs, investors and professional advisors recently gathered for an engaging event on Strategic Exit Planning: Maximizing Your Personal Value and Impact hosted by the Orange County Community Foundation (OCCF). The wisdom from the expert panel was consistent and clear: it’s never too early to begin planning for a business sale and the more planning you do, the better your outcomes will be in optimizing tax impacts, maximizing financial benefits, and enabling philanthropic as a result of a business exit.

Tiffany House, founder of Tax & Estate Strategy, delivered a compelling keynote that left the audience with much to consider. “Ninety-nine percent of business owners agree that having a transition strategy is essential for both their future and their business’s future,” she noted. “Yet, 79 percent have no written transition plan, 48 percent have done no planning at all, and a staggering 94 percent have no written personal third-act plan.”

She explained that the two largest wealth transfers in life—death and selling a business—require careful thought and preparation. “Seventy percent of wealth doesn’t make it to the second generation,” she said, “and 90 percent doesn’t survive to the third. Without a plan, that wealth disappears.”

One of the most eye-opening moments of House’s talk came when she described the difference between a business asset sale and a stock sale. “Most S Corps are sold via asset sales, meaning a portion of the proceeds could be taxed at an ordinary income tax rate of 35 percent or more,” she explained. “Compare that to stock sales, which are taxed at capital gains rates as low as 23.8 percent. If you’re a business owner and you’re not willing to give the IRS up to 40 percent of your sale, you need to start planning now.”

Following her keynote, House moderated a discussion with three local professional advisors: Jill Juniper, CPA, Armanino; Rhonda Ducote, AIF, Apriem Advisors; and Nicole Anderson, JD, LLM, Anderson Law Group. Together, they explored the fundamental pillars of exit planning: planning early, building a comprehensive advisory team, ensuring a strong personal financial plan, optimizing for tax efficiency, and considering personal legacy and philanthropic planning.

“The best exits are planned years in advance,” said Anderson. “I had one client who came to me with ample time, and I was able to help mitigate California tax on a sale with a non-grantor trust. But I’ve also seen business owners come to me after signing a Letter of Intent, and by then, it’s too late.”

Ducote emphasized the importance of treating exit planning as a continuous process rather than a one-time event. “Just like a will shouldn’t be developed and sealed away, nor an estate plan be left untouched, an exit plan needs regular updates,” she said. “Tax laws change, family structures evolve, and life happens. You need a plan that works in the future, not just today.”

Building a strong advisory team is another crucial step, the panelists agreed. “You might leverage a business attorney, M&A specialist, CPA, financial advisor, estate attorney, and philanthropic advisor at the table,” said Juniper. “Too often, I’ve seen clients outgrow their advisors. As your wealth and complexity increase, your advisory team should evolve with you.”

Ensuring a solid financial plan is equally vital.

“Many business owners assume a large payout equals long-term security,” said Ducote. “But without proper scenario modeling and wealth preservation strategies, they may find themselves in trouble post-sale.”

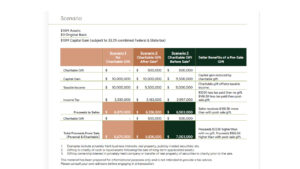

This scenario demonstrates the benefits of early business exit planning in a $10 million business sale. Specifically, if a $500,000 gift of appreciated privately-held stock is donated to a donor-advised fund before the business exit, the proceeds are $333,000 higher than with no gift and $166,500 higher than with a gift post-sale.

Tax efficiency was a hot topic, as Ducote recounted a story of a business owner who was delighted with a $15 million offer for his company but because he did not plan ahead and was not ready for the sale, and he walked away with only $7 million in hand. If he had planned ahead, he could have saved millions in Federal and State taxes, put aside a significant amount for philanthropy and increased his own returns.

Legacy planning was another key theme, with Anderson stressing the importance of early family discussions. “So many founders don’t involve their families in legacy and philanthropic planning,” she said. “It’s critical to ensure the next generation is prepared to be good stewards of family wealth.”

The conversation turned to donor-advised funds (DAFs), with panelists highlighting their benefits over private family foundations. “DAFs offer flexibility and ease,” said Juniper. “Running a foundation is like running a business. For many, a DAF is a better option.”

As the event wrapped up, OCCF’s CEO Shelley Hoss provided a sobering reminder. “Too many times, an entrepreneur knocks on OCCF’s door when they’re already too far down the road on a sale to factor in philanthropy for tax purposes,” she said. “I’ve seen successful business owners on the verge of tears as they see the staggering effects of not planning well enough ahead to take full advantage of their exit event.”

For those contemplating a business sale in the next five to ten years, the message was clear: start planning now. Proper exit planning can protect wealth, secure a legacy, and create opportunities for meaningful philanthropy.

Entrepreneurs looking to explore tax-efficient strategies and philanthropic giving should reach out to OCCF to begin the conversation.

For those contemplating a business sale in the next five to ten years, the message was clear: start planning now.

Proper exit planning can protect wealth, secure a legacy, and create opportunities for meaningful philanthropy. Explore these Business Exit Planning Tips as you embark on your planning process.

View Tips