Donor-Advised Funds

Nonprofits who wish to give their donors a way to support the mission of the organization forever may consider opening an endowment at the Foundation.

Once you establish a fund using cash, stock, or other assets, you can recommend grants to the nonprofit organizations of your choice without geographic restrictions. Grants will be acknowledged in any way you choose—in your name, the name of your fund, or anonymously.

You can establish a fund today, make charitable grants now or in the future, and add to your fund at any time. We can provide guidance on local issues and organizations, drawing upon the Foundation’s extensive experience in Orange County, as well as design strategies for impact across the nation or around the world.

Designated Nonprofit Fund

A Designated Fund allows you to make grants automatically to specific nonprofits will provide regular support in perpetuity. Donors can make direct contributions to this fund.

Nonprofit Endowed Funds

Established by a nonprofit for the charity’s own benefit. An annual scheduled distribution payout is available. Donors can make direct contributions to this fund.

How it Works

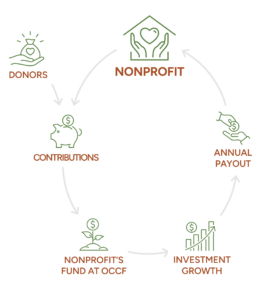

A nonprofit endowment fund is a powerful way for nonprofit organizations to build stability for their future. The nonprofit establishes the fund and is its sole beneficiary in service of its charitable mission. Funds are invested in OCCF’s long-term investment pool, allowing the nonprofit to access annual payouts as needed while the balance of the fund continues to grow. This strategy provides stability, supports long-term growth, and ensures that contributed principal is preserved in perpetuity.

Advantages

Advantages

- Sustainable Income: Establishes a perpetual source of income for your organization.

- Expert Financial Management: Benefit from safe and strategic investment oversight within OCCF’s long-term investment pool.

- Growing the Good: OCCF provides a sound investment approach through our diversified portfolio which is managed to preserve capital while benefiting from upside potential in strong financial markets.

- Flexible Contributions: Donors can contribute directly to the fund with assets such as stocks, real estate, business securities, retirement funds, and life insurance.

- Legacy Gifts: Facilitates planned legacy gifts directed towards the endowment.

Contributions and Annual Payout

- Initial Setup: A minimum initial contribution of $25,000 is required to establish the fund. There are no fees for fund set-up.

- Ongoing Contributions: Nonprofits and donors can contribute at any time, either through OCCF or directly to the nonprofit.

- Annual Payout: An annual scheduled distribution payout is available. Nonprofits can choose to take the payout or defer it to the future as needed.

OCCF Services Provided to Nonprofits

- Complex Gift Management: We handle non-cash gifts that may be challenging for nonprofits to accept.

- Donor Options: We discuss and explore various giving options with donors, including gifts from trusts and other planned gifts.

- Strategic Partnership: OCCF will work closely with your organization to navigate gift acceptance and endowment growth.

Why Choose OCCF?

- Proven Impact: Since 1989, OCCF has facilitated over $1.1 billion in grants and scholarships and stewards nearly $800 million in charitable assets.

- Track Record: OCCF is the 7th most active grant maker among more than 800 U.S. community foundations, and in the top 7 percent for assets.

- Depth of experience: OCCF currently administers over 70 nonprofit endowment funds totaling more than $28 million, and a total of 650 charitable funds.